How To Safeguard 🔐 Your Investments As Central Bank Raises Interest Rates?

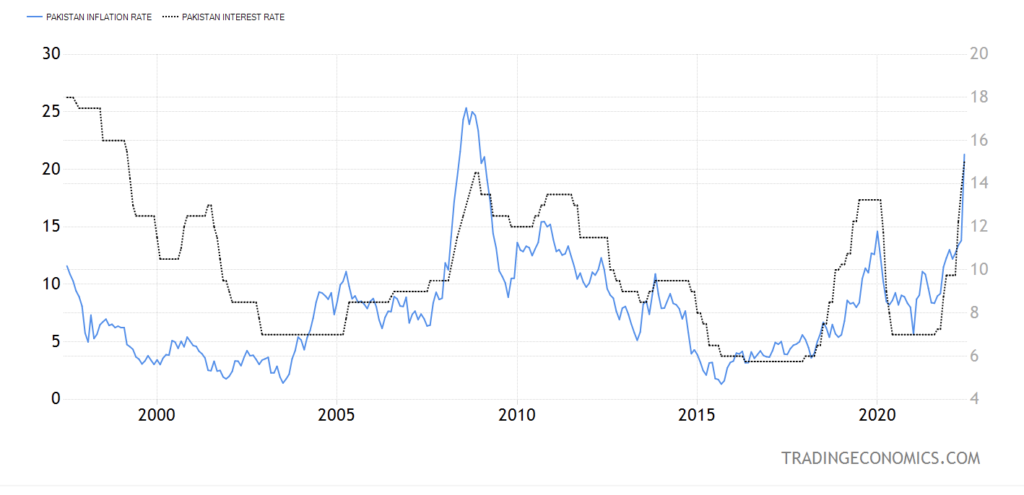

State bank of Pakistan has recently hiked interest rates which I also mentioned in one of the previously recorded video – this is inline with the market expectation due to exorbitant inflation, not only in Pakistan but around the world. The central banks globally are taking similar approach in order to curb the inflation and demand – the question is, will it really impact the essential commodities prices specially oil & arrest the rising prices? the answer is NO ❌ as most of the commodities price increase is linked to either supply side issues or the on going war (Russia vs Ukraine).

🔷 The macro economics aspect

Then why do central banks increase the interest rates and what to expect from this rate hike? Actually increasing the interest rates will eventually impact the cost of living as increasing the interest rates will translate to lesser mortgages, fewer car financing, less attractive consumer debt – all these will eventually suppress the demand of these consumables translating into cooling house prices 📉 (some stability in rentals too), less demands for cars, less options to spend easy money, so on and so forth. Moreover, existing loans which are tied to market driven interest rates will also increase. So, even in a country like Pakistan, where the consumers are not driven by debt – increasing interest rates does have the impact to curb inflation somewhat.

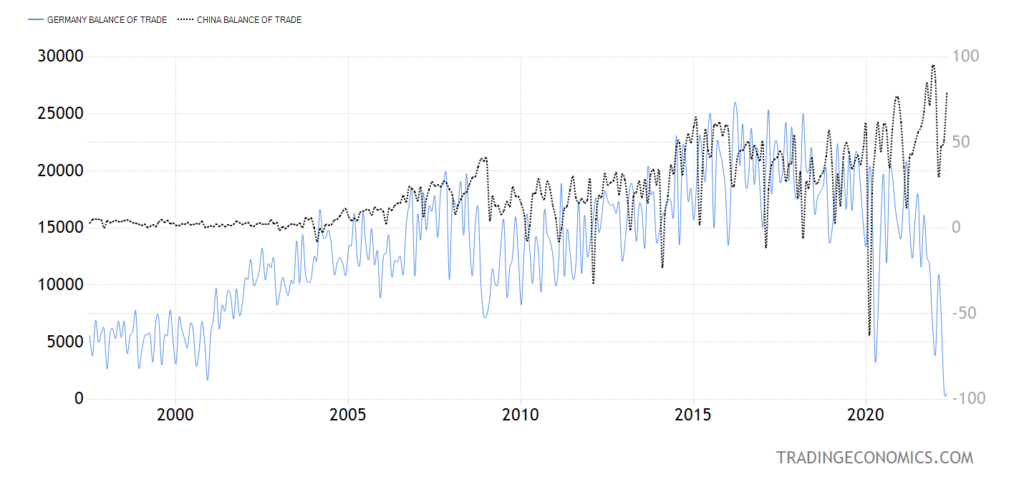

Although the issue of inflation 🏷 & hike of interest rates is global – but the problem with Pakistan has been the trade imbalance, as we have been unable to increase our exports compared to the consumption we are use to. Although recently, even a country like Germany has severe issues of trade imbalance where it nose dived to levels not seen in last 25 years – at the same time, a country like China has sustained its trade balance as shown in the chart below. We need to be more productive in Pakistan and efficiencies need to improve as a nation & as individual too.

🔷 The personal finance aspect!

Now, irrespective of macro economic situation, the point is how you can save yourself from the impact of rising cost of living – even real estate 🏡 which is considered to be a safer & inflation proof asset has not appreciated recently to an extent that it can bolster your rental yields, however past trends show that as soon as the interest rates start going down, the assets like stocks & real estate will start to go up in a matter of time – discussed in this writeup.

For now, if you have any cash lying around for short term needs, it may go into either T-bills or money market funds which can help you gain something rather than keeping the cash in equity based mutual funds or into the bank accounts. I am always a proponent of long term investing in stocks – but not every penny 🪙 you have is for long term investment, so for the short to medium term – the best bet as of now are the above two options while staying partially liquid too.

In case you are interested to invest in a crowd funded property in the UAE, you can signup using the referral link and earn 250 AED bonus once you fund your account: https://my.smartcrowd.ae/?signup=true&r=wkhan You may want to consider other options as discussed in this writeup too in today’s high inflationary environment – in all cases, make sure you have emergency fund sorted.

About Myself

I post 3 videos every week on my YouTube channel on the topics of productivity & personal finance specifically for expats & in general for wider Pakistani community. Besides this, I update this website / blog on weekly basis so do visit regularly for updates – To get value out of the content, please consider subscribing both the YouTube channel and the newsletter.

Videos uploaded in last few days, in case you missed

My social media handles:

Twitter

Instagram

Facebook

Linkedin

Tiktok

Youtube (Main channel)

YouTube (Q&A Clips channel)

KEEP HUSTLING 😉