Your Surplus Cash 💵 Should Go Into These Avenues!

We are living in an unprecedented era which was never witnessed before at least in our lifetimes and even beyond in many aspects. The way developed world has handled pandemic along with some geopolitical issues has caused sky rocketing inflation in countries which were not use to of it before.

During Covid-19, crazy printing of money by the US and other governments around the world made easy money available to many causing extra cash to be invested in all kind of speculative investments – even turning the most conservative investments the speculative heaven.

During this whole time, investments like stocks, real estate, crypto currencies even startup businesses attracted serious money. If you follow me on twitter, I discussed this and a few reasons of how the insane funding boost the startup scene all around the world including Pakistan – but as those inflows are now drying up, the companies relying on burning cash to survive are going busted.

In this writeup, we shall discuss about some investment options that we have in current circumstances both for expats and resident Pakistanis alike with a perspective of on going inflation and commodities super cycle. Lets dive into the opportunities one by one and analyze all on their merits.

1 – Investing in fixed 🏦 return instruments

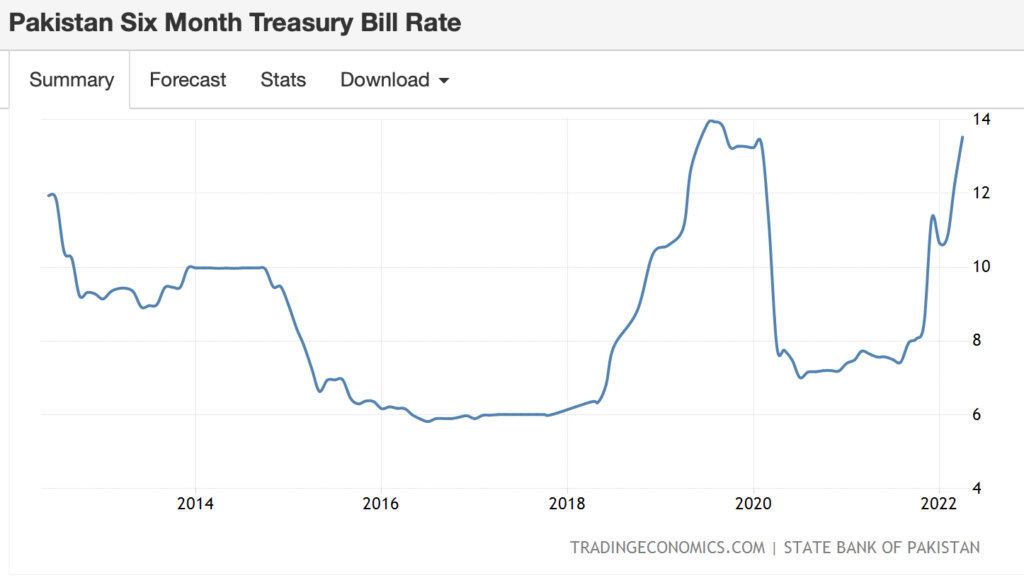

With soaring interest rates all around the world while central banks are trying to contain inflation the fixed returns look attractive for now. There are multiple options you have while in Pakistan such as National savings, Bank deposits, T-Bills etc.

One can get best returns out of fixed return T-bills of upto 14% as of recent auction based on the tenure you choose along with how much cash you have to invest as usually T-bills are best when you have good amount of cash available to invest. If you feel that the rates have peaked, you can also lock to a longer tenure as these rates can stay low in future and you can enjoy high yield in years to come.

If you have small amount of cash or want to stay liquid then your best bets can be national savings or a savings account in conventional or islamic bank which will provide you some kind of return albeit less than inflation.

Having said that, do have a look at the write up about the flip side of fixed income here before finalizing your next fixed income return. Moreover, if you are an expat, then do give Naya Pakistan Certificate & Roshan Digital Account a serious thought specially in USD terms.

In the UAE, you can go for fixed income instruments like National Bonds – you can even apply from outside UAE for these bonds. If you are in the US, make sure you check the option for I bonds – this is one of the best weapon against inflation albeit with multiple caveats. Research before you invest in any of the above mentioned instruments as there are pros and cons associated with each.

2 – Mutual Funds 📝

There are a variety of mutual funds available in the market from equity to money market – as a general rule of thumb during high interest era the money market funds provide better returns than the equity ones. However, at the same time, during the high interest era the equities are generally available at a discount so accumulation is important at every level as eventually when things settle down the equities will go up.

Having said that, the abysmal performance of mutual funds in Pakistan specially in last 5 years attributed to bad stock market performance is evident and I would recommend new investors to start with equity mutual funds to begin with but learn & make path towards direct stocks within 1-2 years in order to take the control in their own hands. I have discussed this in the video here and here.

3 – Real estate 🏡

Real estate has been one popular asset class all across the world! While not providing the best of returns in general – it is one solid asset class which will hold its value through think and thin. Just make sure there is no speculative element while investing in any property and in longer run it will definitely provide good capital appreciation along with rental returns. Remember! inflation hits the housing market too and cost of making home will always go high along with price of land.

One can invest in real estate either with physical property or by other means like REITs or crowd funding platforms. I have discussed a lot on my YouTube channel regarding investing in REITS here as well as crowd funding here – the benefits of both options for real estate investment is that you don’t have to have huge funds upfront and don’t need to go to banks for approvals too. Plus the due diligence is done on an institute level so you have some kind of peace of mind.

In case you are interested to invest in a crowd funded property in the UAE, you can signup using the referral link and earn 250 AED bonus once you fund your account: https://my.smartcrowd.ae/?signup=true&r=wkhan You can use the above referral link to invest in listed properties in the UAE and around the world with smartcrowd even with a small ticket as low as 500 AED.

4 – Stocks 📊

Stock markets can be bumpy. We have seen Japanese stocks in last 40 years still have not recovered back to a level that was seen in 1990s – however, that was certainly a different scenario and can be discussed in later write-ups and should not create panic for anyone investing in stocks in Pakistan or USA in current days.

What one need to understand is that investing in stocks come with inherent risk and should always be considered like that. About investing in equities in a country like Pakistan where currency devaluation is imminent and returns are eroded on monthly basis in a high inflation environment one has to go through this article before making any decision.

💡 Invest in SARWA with this link and get 💰 $50 as referral bonus once you fund your new SARWA invest account: ✅ https://bit.ly/Sarwa-Wali with minimum investment of: $5 in conventional portfolio $500 in halal portfolio $2500 in socially responsible portfolio: $2500 $2500 in any portfolio with crypto: $2500

I have talked in detail about why I have started investing in Apple stocks and how is my SARWA investment going in the write up here as well as video here.

Investing in stocks is a risky proposition so due diligence is required in all times. Just don’t consider this as a get rich quick scheme and have patience and build your portfolio over time. You can use the above link to signup with SARWA and get your free $50 bonus when you fund the account with SARWA invest.

5 – Gold 🌟

I have always been against investing major portion of one’s investment in gold like I discussed here – however, without doubt this is something which still holds emotional value in the mind of general public as well as it has some industrial use too. If you really want gold into your portfolio, than it should not be more than 10% of your net worth at any given time, however, if someone is residing in a country like Pakistan with depreciating currency, the max percentage can go upto 20% – but certainly not beyond that threshold for gold being unproductive asset.

The reason for being conservative with gold is the trend of price we have seen over last few decades along with the time in pandemic, commodities super cycle, war, inflation in last 3 years. It has not provided any growth whatsoever and the proposition of it being the “hold of value” fails here.

6 – Government & companies backed pension 📜 schemes

Government backed schemes are not as sexy as many other prevailing investment opportunities but having some kind of exposure in such instrument is always recommended whether its Voluntary Pension Scheme (VPS) based mutual funds or company provided pension scheme where the company will match the contribution you make for building up the retirement pot or famous programs in the US like 401K.

Although these schemes might have low returns – but we have seen over the period of time these are sustainable schemes and in down times will protect your investments and hold value more than volatile instruments like direct equity investment. Moreover, these are tax efficient as well so you save more on taxes too – minimum exposure to such schemes and instruments should always be there.

7 – Bitcoin & Crypto Currencies 🔐

I don’t consider Bitcoin or any other medium of payment as investment opportunity. For speculative purpose you can invest a little amount (I wont do for my money) but playing with money while doing trading on buy and short signals is not something I am interested in as the same can be done in any stock market or casino. I have discussed the same here in this video.

The price fluctuation in all the crypto currencies and scandals around stable coins providing exorbitant interest rates is known to everyone now and further reading can be done here.

The inherent technology which forms the basis of crypto currency might be beneficial but until the governments around the world generate acceptability for this payment mechanism, it will never thrive and always be prone to sanctions. Once the governments regulates and accept it as payment mechanism it might not be in the same form as it is today and will become controlled which is against the essence of whole crypto ecosystem

Similar case is of NFTs – If you have not read the news about how twitter’s founder’s first tweet’s NFT was sold for $2.9 million and later the buyer only got $280 when auctioned – then do read it here.

About Myself

I post 3 videos every week on my YouTube channel on the topics of productivity & personal finance specifically for expats & in general for wider Pakistani community. Besides this, I update this website / blog on weekly basis so do visit regularly for updates – To get value out of the content, please consider

I post 3 videos every week on my YouTube channel on the topics of productivity & personal finance specifically for expats & in general for wider Pakistani community. Besides this, I update this website / blog on weekly basis so do visit regularly for updates – To get value out of the content, please consider subscribing both the YouTube channel and the newsletter.

I post 3 videos every week on my YouTube channel on the topics of productivity & personal finance specifically for expats & in general for wider Pakistani community. Besides this, I update this website / blog on weekly basis so do visit regularly for updates – To get value out of the content, please consider subscribing both the YouTube channel and the newsletter.

Videos uploaded in last few days, in case you missed

My social media handles:

Twitter

Instagram

Facebook

Linkedin

Tiktok

Youtube (Main channel)

YouTube (Q&A Clips channel)

KEEP HUSTLING 😉