7 months since I promised myself to invest into the company before buying the device!

As I have mentioned in this write up earlier that from now on, any new iPhone that I will buy will have to filter through the new strategy which is also implemented for all other big purchases falling under some kind of luxury category. Although an iPhone has never been a luxury for me as I get so much value out of the device specially since starting the YouTube channel, the value Apple products provide has gone manifold (be it a 💻MacBook, an 📱iPhone or an app like 🎬 Final Cut Pro). All these fits very well into the ecosystem I work in and enable me to be more productive.

However, to reiterate – cost of an iPhone is huge & it is by no mean a small amount which is about to be spent and require some prior planning before the purchase. Specially when I am not only buying the device for myself, but for my wife too. To begin with, the average lifespan of a cell phone with me is 4-5 years and even after that it remains with me for some time as a repurposed second phone (we still have our 8 years old iPhone 6S providing value till date.)

So, I decided in principal, for any major 🛍purchase, I will plan properly well in advance & try to invest similar or reasonable amount in the same company where possible or in the stocks of a company in similar niche. In this particular case, it was easy for me to invest in Apple as SARWA (which is my primary US stocks trading / investment platform) recently launched their trading platform.

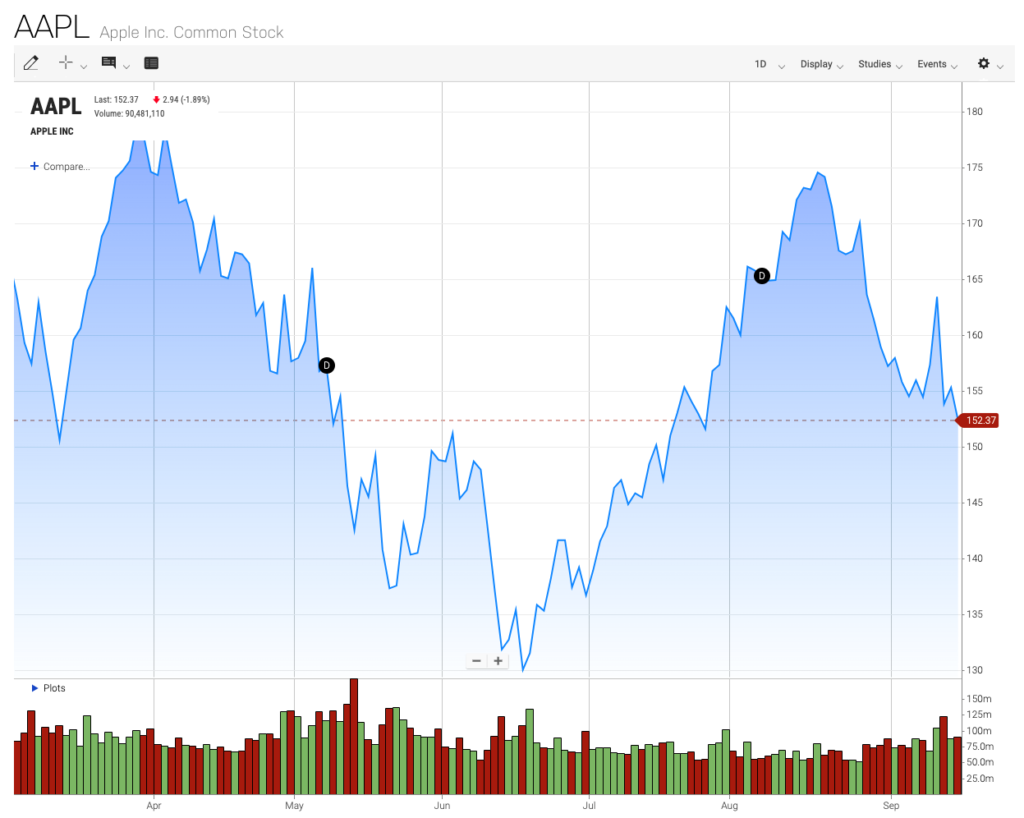

💵 BTW, if you are interested in investing with a robo-investor platform which gives you the option to invest in a wide variety of US stocks along with developing market's exposure (specially from the UAE) then do signup using this link as you will get $50 once you invest with SARWA with atleast $2,500 within 3 months of signing up: ✅ https://bit.ly/Sarwa-WaliBelow is the 📉chart of apple stock price since I have started investing where you can see how volatile the situation has been – but what I have learnt in all these years is that if you believe in a company and the company has strong products with solid dividend history with strong fundamentals, you cannot go wrong if you plan to dollar cost average your investment💰.

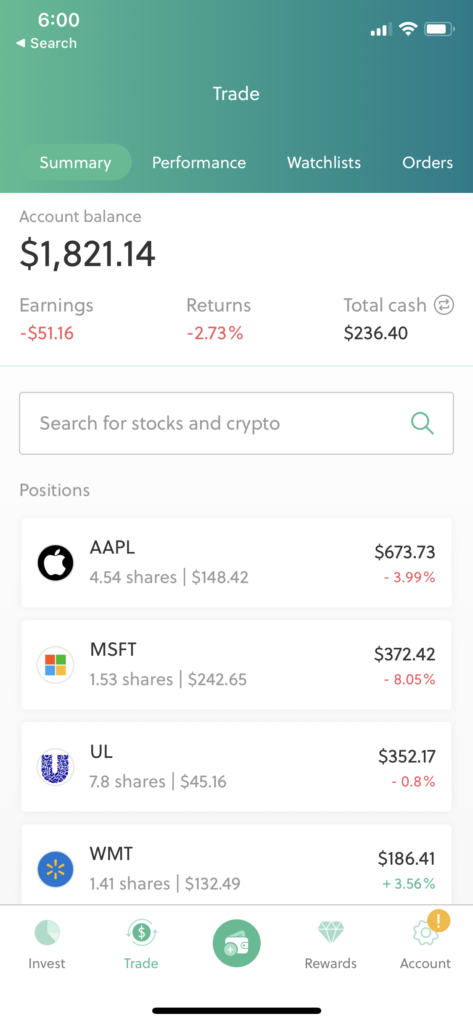

Here is how the portfolio looks like with SARWA and its not a good sight – but I have a 10-15 years horizon for the funds I am investing in, moreover, I am investing one particular amount on monthly basis so eventually I will have a good average position for all these dividend yielding stocks. Just a month back – in this video, I claimed a positive return for US equities I am invested in and now after a month most of them are negative. This is part of the game! what if I tell you I am net positive with PSX investments today! But really, that’s not the point to discuss for any long term investor. I am happy that I am investing consistently and getting dividends from my investments which I am reinvesting using DRIP plan.

Although I started investing in Apple stocks targeting the 2023 iPhone launch but this investment will go on for years to come – the idea is to invest equivalent amount for which an iPhone costs. This for me will be approximately 3,000 USD for 2 phones by Sept 2023. If for any reason I am unable to keep invested for this amount – I might delay the purchase decision as well. Besides, in case I feel the new phone is not providing me enough value – I still can delay the purchase 😀

So hang in there and keep coming back to this space for my future course of action. The point here is to think about a big ticket item purchase carefully and plan accordingly! You cannot just spend large sum of money like that – it has to be a process driven approach rather than impulse buying decision even if its a luxury good! 🔴

About Myself

I post 3 videos every week on my YouTube channel on the topics of productivity & personal finance specifically for expats & in general for wider Pakistani community. Besides this, I update this website / blog on weekly basis so do visit regularly for updates – To get value out of the content, please consider subscribing both the YouTube channel and the newsletter.

Many people from the YouTube community wanted me to start 1-1 session which I have been contemplating as well for long time. I have started taking such sessions on booking basis with the following core topics of discussion:

- Productivity

- Personal Finance

- YouTube & Social Media Talks

Price for the session can be confirmed by emailing your details at financewithwali@gmail.com

Disclaimer: I am not a financial advisor and consider these sessions for knowledge sharing and discussion only.

Videos uploaded in last few days, in case you missed

My social media handles:

Twitter

Instagram

Facebook

Linkedin

Tiktok

Youtube (Main channel)

YouTube (Q&A Clips channel)

KEEP HUSTLING 😉